CS2 Rostermania Winter 2025 Ranked: From “Off-Season Storm” to Gentle Breeze

CS2 Rostermania Winter 2025 Ranked: From “Off-Season Storm” to Gentle Breeze

After the Budapest Major, the Counter-Strike 2 scene braced for chaos. With Vitality dominating the 2025 season and several elite teams falling short on the biggest stage, expectations were clear: top-tier rosters would break apart.

Instead, as HLTV aptly summarized, “we were promised an off-season storm — instead it was but a breeze.”

Below is a ranked breakdown of every impactful CS2 roster move, why most teams stayed frozen, and how market forces quietly reshaped the winter transfer window.

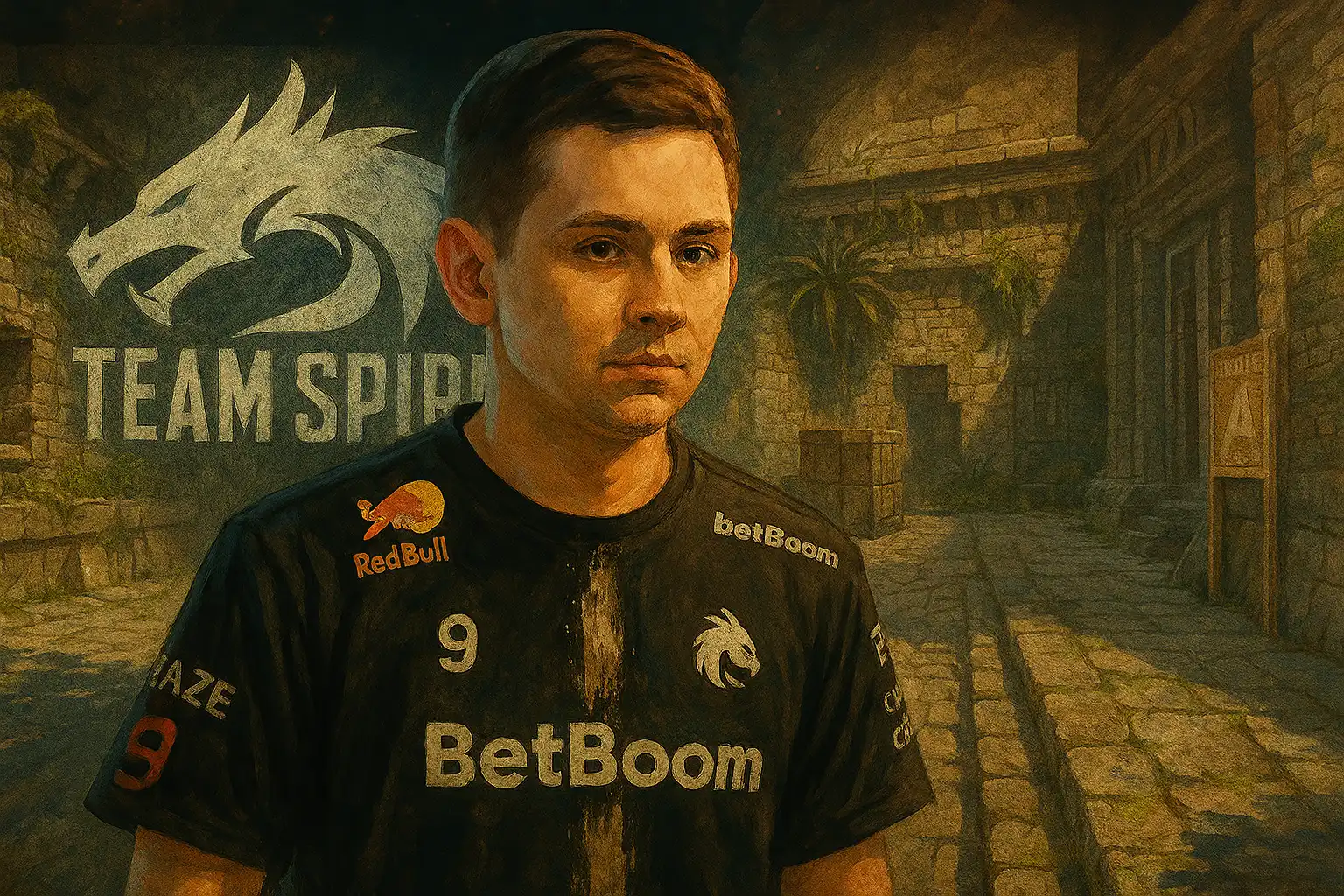

1️⃣ Spirit — The Only True Tier-One Shake-Up (Grade: A-)

Spirit were the only established contender to fully commit to change. They:

Reintroduced magixx and zont1x into the active lineup

Benched chopper and zweih

Handed in-game leadership to magixx

This wasn’t a cosmetic tweak — it was a structural reset, especially notable given Spirit’s mixed but trophy-bearing second half of 2025.

2️⃣ The MongolZ — Progress Without Closure (Grade: B+)

The MongolZ officially moved on from controlez, who had been standing in, but failed to finalize a fifth player heading into early 2026.

The uncertainty around long-term roles — including ongoing discussion about Senzu’s position — keeps The MongolZ relevant in the rostermania conversation, but incomplete.

3️⃣ Aurora — A Controlled Upgrade Attempt (Grade: B)

Aurora made a single, targeted move:

jottAAA benched

soulfly added

The team opted for incremental improvement, not reinvention, with their updated lineup debuting during BLAST Bounty 2026 Season 1 online play.

4️⃣ B8 — AWP Role Under the Microscope (Grade: B)

While not a top-10 staple, B8 generated serious attention by:

Listing headtr1ck for transfer

Opening AWP tryouts

The organization emphasized that no final decision had been made, but the move highlighted a recurring theme of the off-season: AWP instability.

5️⃣ The PR That Never Happened (Grade: B-)

The name most expected to trigger domino moves was PR — but contractual realities cooled interest. Buyback clauses and inflated valuations made a transfer impractical, and MOUZ chose continuity instead.

This stalled what could have been the off-season’s first true chain reaction.

6️⃣ MOUZ — Standing Still Under Pressure (Grade: B-)

MOUZ’s decision not to move places heavy pressure on early-2026 results, especially after a quarterfinal Major exit. With roster expectations rising and little margin for stagnation, continuity becomes both a strength and a risk.

7️⃣ Why the Market Froze: Prices and AWP Scarcity (Grade: C+)

Two structural issues defined the window:

Inflated transfer fees, limiting even ambitious teams

A shortage of elite AWPers, making upgrades risky and expensive

Multiple players and analysts publicly questioned the sustainability of the current market, turning financial reality into the biggest roster gatekeeper.

8️⃣ HLTV Confirmed — The Pulse of Rostermania (Grade: C+)

Discussions on HLTV Confirmed reinforced the same conclusion: teams wanted to move, but couldn’t justify the cost.

When insiders and players agree, the narrative is no longer speculation — it’s market diagnosis.

9️⃣ IEM Kraków — The Silent Deadline (Grade: C)

With ESL confirming the team list for IEM Kraków, patience will not last forever. Poor early-season results could quickly reignite roster talk, especially for teams that chose continuity.

🔟 The Quiet Winners — Teams That Held Their Line (Grade: C)

In an inflated market, simply keeping your roster intact became a strategic win. HLTV highlighted FUT as an example of stability paying off amid widespread uncertainty.